This article explains why German food imports UK 2026 remains buyer-relevant: the UK is structurally import-led in food and drink, and Germany is still one of the UK’s most important source countries.

It then focuses on the clearest “German lane” for procurement—pigmeat—because it is a large import category, overwhelmingly EU-supplied, where Germany holds a meaningful share even when disease controls temporarily disrupt flows.

Finally, it links that supply reality to German sausages (bratwurst, frankfurters, Weisswurst and hotdogs): practical, specification-led formats that buyers can standardise across retail and foodservice.

German food imports UK 2026: Swabian-Hall pigs in a natural outdoor habitat—an iconic German breed linked to premium pork traditions.

Introduction

If you want a realistic, data-led outlook for German food imports UK 2026, it helps to step back from the “one-year noise” that often dominates trade headlines and instead focus on what procurement teams actually optimise for: category scale, continuity of supply, compliance confidence, and the stability of the supply lanes that keep shelves and menus running. Buyers rarely make strategic decisions on a single quarter or a single incident; they plan around structural realities—what the UK consistently imports, who the dependable origin lanes are, and which formats can be specified, ordered, delivered, stored, and executed without surprises.

The structural picture is straightforward. The UK’s food, feed and drink imports are large, and Germany remains a top-tier source country within that system. That matters because it means “Germany” is not a novelty angle—it is a meaningful supply lane with scale, maturity, and established trade routes into UK retail and foodservice. When you translate that to procurement, it supports an evidence-based story: German-origin and German-style products sit naturally inside buying missions that prioritise specification discipline, reliable case formats, and predictable performance in real operations.

Pigmeat is where this becomes most commercially tangible. It is one of the UK’s most important high-volume protein categories and a major import lane, which makes Germany’s role especially relevant. In pigmeat, Germany is not a niche supplier; it is part of the core supplier set that buyers rely on when they need consistent supply at scale. That is why pigmeat is such a useful lens for German food imports UK 2026: it links directly to the format-driven reality of what buyers actually list and sell—processed pork products and specification-led items that can be standardised across multiple sites, seasons, and service styles.

Even when animal-health controls create short-term turbulence, the underlying buyer logic remains the same. Imports are still required, EU sourcing remains dominant, and the market tends to re-route volumes rather than abandon the lane altogether. For 2026, the more realistic takeaway is therefore not “will the category magically grow?” but “which suppliers can reduce risk and friction?”—through consistent EU supply, consistent formats, consistent specifications, and the documentation and QA standards that allow buyers to keep trading through volatility.

Key Takeaways

- UK food, feed and drink imports were £64.1bn in 2024, and rose in real terms after adjusting for trade price inflation—so German food imports UK 2026 is fundamentally a “share within a large import market” story.

- Germany was the UK’s #5 source country for food, feed and drink imports in 2024 at £4,826m—a structural importance point that is stronger than any single-category headline.

- The UK imported 789,300 tonnes of pigmeat in 2024, while producing 960,800 tonnes—imports are commercially central, not marginal.

- Over 99% of UK pigmeat imports are sourced from the EU27, with Denmark (25%) and Germany (23%) holding the largest shares (as of June 2024 YTD).

- Early 2025 controls linked to a German foot-and-mouth disease case temporarily disrupted trade—but the UK later lifted the ban, reinforcing that these shocks are typically episodic rather than permanent demand shifts.

Germany’s role in the UK import picture

When writing about German food imports UK 2026, it is far more persuasive to start with the UK’s overall import structure and only then zoom into individual categories such as German pork imports UK and UK pigmeat imports Germany. That approach mirrors how procurement teams think: they do not start with a single product; they start with the size and stability of the supply lane, the reliability of origin countries, and how easily specifications can be maintained across retail and foodservice.

Germany is a top-tier source country for UK food imports

In the official UK trade reporting, Germany is not a marginal supplier. Defra’s Agriculture in the UK 2024 (Overseas trade chapter) lists food, feed and drink imports by country of dispatch and shows Germany at £4,826m in 2024—making it the 5th largest source country for UK food, feed and drink imports that year.

That single data point is powerful for German food imports UK 2026 because it reframes the whole discussion. It is not a “German food trend” story that depends on a short-term consumer fashion; it is a structural supply story. Germany is a top-tier origin lane that UK buyers already rely on across multiple categories, and that matters when you are range-planning for 2026 with an emphasis on continuity, compliance and consistent specifications.

UK food imports are large, and the import-driven structure remains

Defra also reports that the UK imported £64.1bn of food, feed and drink in 2024, and notes that imports increased in real terms after adjusting for trade price inflation.

For German food imports UK 2026, the buyer implication is practical and commercially relevant: the UK remains a large, import-reliant market, so the key question is not whether imports “exist”, but which suppliers win share by executing better. Suppliers that can deliver EU-spec consistency with UK-market practicality—stable case formats, predictable lead times, clear documentation, and product specifications that do not drift—will continue to be favoured by procurement teams.

Why this matters specifically for German pork and sausages

Once you accept the structural picture—large UK imports, and Germany as a top-tier source—the “zoom in” becomes clearer. German pork imports UK and UK pigmeat imports Germany matter because pigmeat is one of the most operationally important protein lanes, and it supports a broad ecosystem of processed pork formats. That is exactly where German sausages market UK becomes commercially meaningful: sausages are specification-led, standardisable, easy to execute at scale, and sit naturally inside EU supply lanes that procurement teams already trust.

In other words, German food imports UK 2026 is not a narrative you have to “sell”. The data already shows Germany is a major lane. The opportunity in 2026 is to translate that lane into buyer-friendly, repeatable formats—especially in pigmeat-linked products such as German-style sausages—where consistency and execution are what ultimately drive listings, repeat orders, and long-term account value.

The pigmeat lane: where Germany is commercially unavoidable

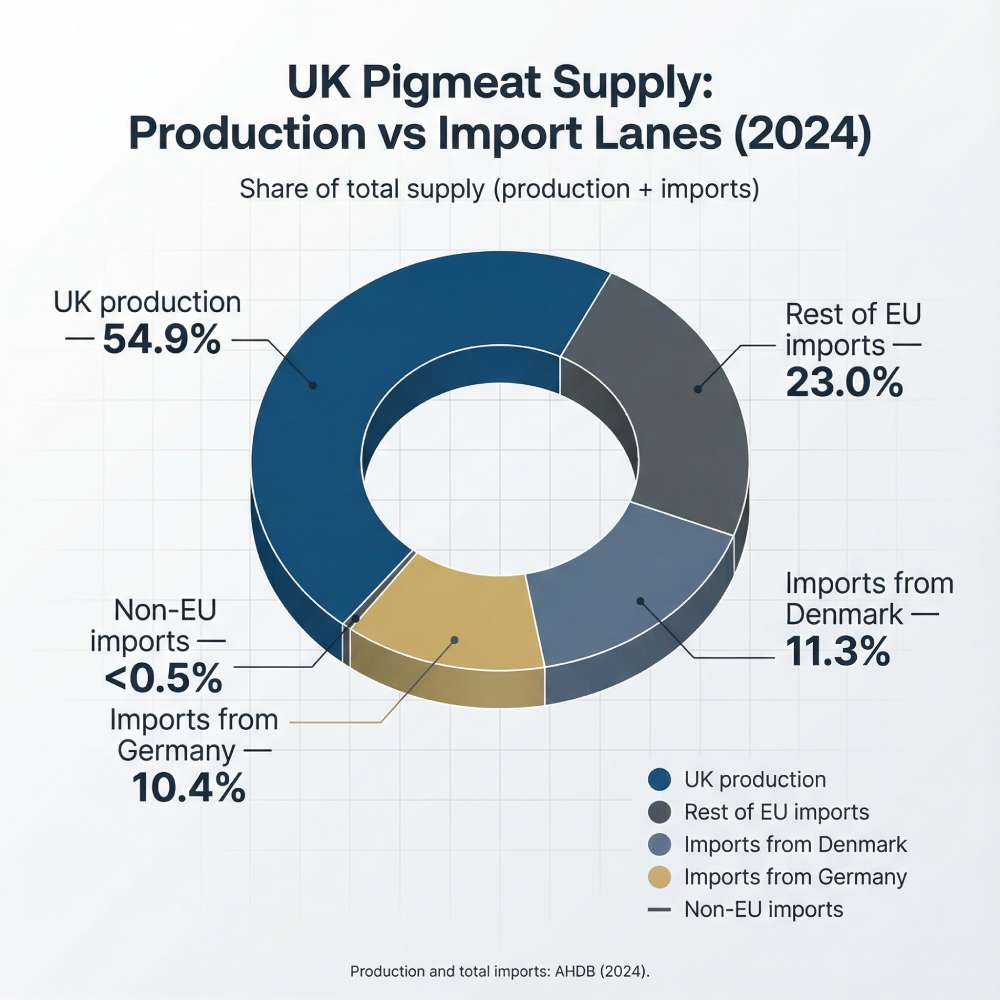

German food imports UK 2026: UK pigmeat supply is roughly half domestic production and half imports, with Germany and Denmark as major import lanes (2024).

If you want one category to make German food imports UK 2026 feel immediately relevant to wholesalers, retailers and foodservice buyers, pigmeat is the cleanest lane: it is high-volume, specification-driven, and tightly linked to processed formats (including sausages).

UK pigmeat imports are large (and relatively stable)

AHDB reports the UK imported 789,300 tonnes of pigmeat (including offal) in 2024, a small increase of about 1% year-on-year.

- UK production: 54.9% of total UK pigmeat supply (2024)

- Imports from Germany: 10.4%

- Imports from Denmark: 11.3%

- Rest of EU imports: 23.0%

- Non-EU imports: <0.5%

This matters because it is not “nice to have” volume—it is demand that the UK consistently fills via trade.

UK production is substantial, but imports remain central

AHDB also reports UK pigmeat production at 960,800 tonnes in 2024, alongside those 789,300 tonnes of imports.

For German food imports UK 2026, this supports a balanced buyer narrative: domestic production is meaningful, but procurement is still designed around imports as a normal, ongoing part of supply.

Germany’s share is structurally large inside an EU-sourced import market

AHDB’s trading-partner analysis states that over 99% of UK pigmeat imports are sourced from the EU27, and that Denmark (25%) and Germany (23%) held the largest market shares (year to date, as of June 2024).

That is exactly the kind of “structural importance” statistic that lets you write German food imports UK 2026 confidently without pretending you can predict the future: Germany is already a top supplier inside a market that is overwhelmingly EU-sourced.

What disrupted the lane recently (and what it does—and does not—mean for 2026)

You are correct to anticipate that some recent numbers can look “messier” because of controls—but the right way to use that in German food imports UK 2026 is as a resilience argument, not a doom story.

The disruption was driven by foot-and-mouth controls, not “swine flu”

In January 2025, the UK imposed restrictions on imports of susceptible animals and certain animal products from Germany following a confirmed foot-and-mouth disease case.

The ban was later lifted

Reuters reported that Britain ended the ban on German livestock and animal products in March 2025, according to Germany’s agriculture ministry. Reuters

How to interpret this for German food imports UK 2026:

- These events can cause short-term sourcing shifts and volume re-routing.

- They do not automatically imply collapsing UK demand for pigmeat or processed pork formats.

- They reinforce why buyers prefer suppliers with strong contingency planning (multiple plants, flexible logistics, clear compliance documentation).

What to expect from German food imports UK 2026

This section is where many “trend posts” go wrong by inventing forecasts. You do not need that. You can give buyers a credible 2026 outlook using scenario logic that stays anchored to the confirmed data.

Scenario 1: Normalisation and steady EU-led sourcing

If trade flows remain stable, the underlying structure remains: the UK is import-heavy in food and pigmeat, and Germany remains a top-tier source. Under this scenario, German food imports UK 2026 is primarily about execution: service levels, specification discipline, and range engineering.

What buyers tend to reward in this environment:

- stable specifications and weights

- predictable case formats

- consistent eating quality (especially for sausages/hotdogs)

- robust QA and compliance documentation

Scenario 2: Periodic biosecurity volatility with rapid re-routing

Even with improved processes, animal-health events can occur across Europe. Under this scenario, the winner is not the supplier claiming “nothing will ever happen”—it is the supplier who can keep customers supplied through:

- alternative approved production options

- dual sourcing or contingency stock planning

- transparent lead times and substitution rules

This is still a positive frame for German food imports UK 2026, because Germany’s role as a major lane typically means the industry develops faster “return to trade” pathways and higher operational maturity.

Scenario 3: Mix shift toward processed formats buyers can standardise

Even if raw-material costs fluctuate, buyers often protect menu and shelf consistency by leaning into processed formats with predictable handling: cooked/part-cooked items, frozen formats, and products engineered for throughput.

That is where German-style sausages and hotdog formats tend to fit naturally inside German food imports UK 2026: they are practical, standardisable SKUs that perform consistently in UK retail and foodservice operations.

What this means specifically for German-style sausages in 2026

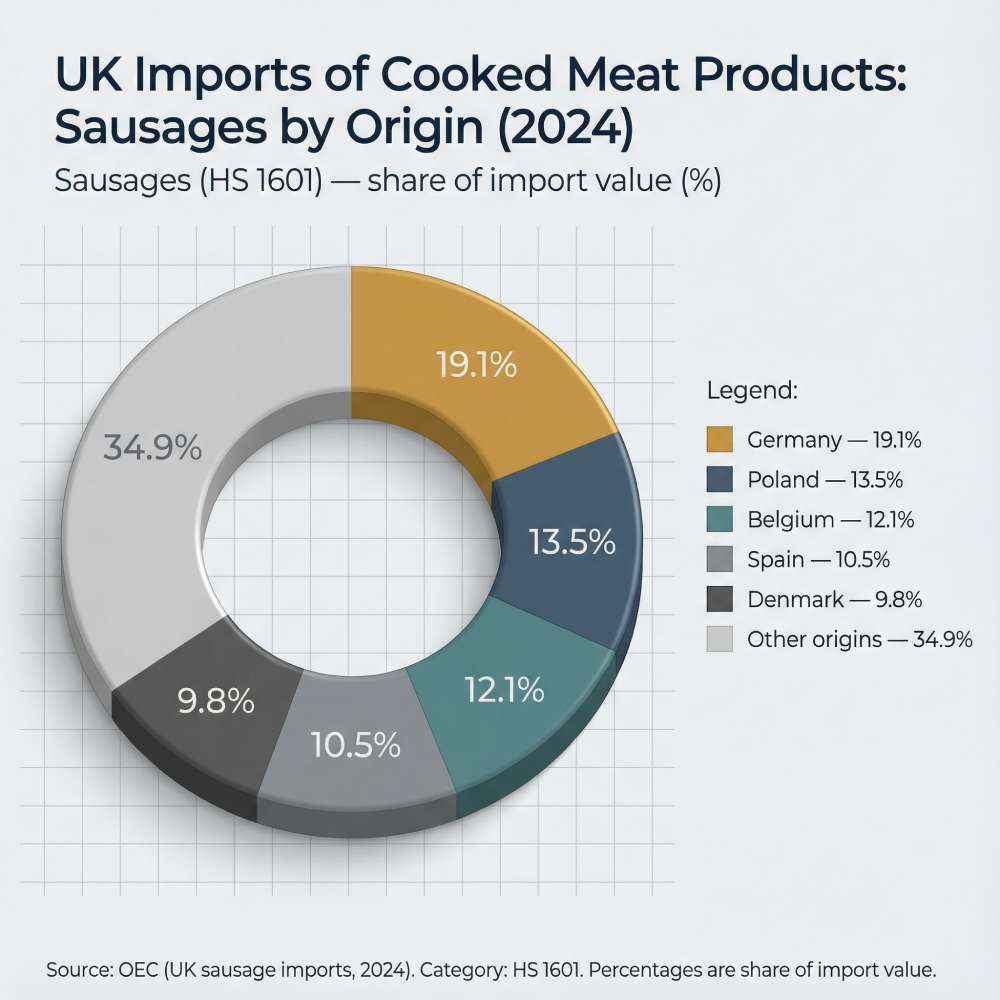

German food imports UK 2026: Germany is the #1 origin for imported sausages into the UK by value (HS 1601, 2024).

- Germany: 19.1% of UK sausage import value (HS 1601, 2024)

- Poland: 13.5%

- Belgium: 12.1%

- Spain: 10.5%

- Denmark: 9.8%

- Other origins (combined): 34.9%

A useful, buyer-facing way to connect pigmeat trade and sausages is to reframe the category. Pigmeat trade is not only about “fresh pork”; it is about the full ecosystem of pork-based formats that move reliably through EU supply chains—trim, meat blocks, processed pork, and finished products built to a specification. That is exactly the ecosystem where German-style sausages sit, and it is why the German food imports UK 2026 story matters for sausage buyers: it supports a lane that is predictable, repeatable, and operationally scalable.

From an operational viewpoint, German-style sausages are attractive because they solve three procurement problems at once:

- Easy to merchandise: The formats are instantly recognisable and easy to communicate at shelf and menu level—bratwurst, frankfurter, and hotdog are straightforward buying missions with clear usage occasions.

- Easy to execute: They are specification-led products with predictable cook methods, portion control, and consistent eating quality—critical for high-throughput foodservice and for retail products where repeat purchase depends on consistency.

- Easy to range-build: You can build a commercially strong range with a small number of base SKUs, then create variety through flavour, toppings, and menu builds rather than multiplying operational complexity.

How this maps to The Sausage Haüs range

For 2026, that logic translates neatly into a tight, buyer-friendly line-up of proven SKUs:

- Bratwurst – the recognisable German hero format: easy to merchandise, versatile across menus, and ideal for hot food counters, events, and seasonal promotions.

- Bacon Frankfurter – a premium twist on a classic frankfurter that sells well as a straightforward upgrade (strong flavour cue, minimal operational change).

- Chilli Beef Frankfurter – a bolder, more contemporary option that supports “spicy” menu call-outs and loaded hotdog builds while staying process-simple.

- Cheese Frankfurter – a clear premium cue that justifies higher price points and naturally drives add-on sales (premium bun, toppings, sides).

- Jumbo Pork Hotdog – a throughput-first core SKU for food-to-go, events, and roller grill-style service where portion consistency and hot-holding performance matter.

- Munich Weisswurst – a distinctive speciality sausage that adds authenticity and range depth, and gives retailers and foodservice operators a strong “occasion” product for weekend breakfast/brunch and themed promotions.

In other words, Germany’s importance is not abstract. It shows up where buyers need it most in 2026: repeatable, scalable, specification-stable protein formats that can be listed, replenished, and executed reliably—while still giving the end customer a clear reason to choose the product (authentic format, premium cue, strong flavour). And that is precisely why German-style sausages remain a commercially meaningful lane inside the broader German food imports UK 2026 picture.

Frequently Asked Questions

In January 2025, the UK restricted certain imports from Germany following a confirmed foot-and-mouth disease case; the restriction was later lifted. This type of event can cause short-term re-routing rather than permanently changing demand.

AHDB reports UK pigmeat production of 960,800 tonnes in 2024 alongside imports of 789,300 tonnes, showing imports are commercially central rather than marginal.

Defra’s trade chapter shows Germany at £4,826m of UK food, feed and drink imports in 2024, placing it among the top source countries and supporting the “anchor supplier” narrative.

AHDB’s trade partner analysis indicates Denmark and Germany hold the largest market shares at 25% and 23% (year-to-date context as of June 2024), underlining Germany’s role as a core supply lane.

Yes. AHDB states over 99% of UK pigmeat imports are sourced from the EU27, which is why EU-origin lanes (including Germany) matter for continuity planning.

For sausages (HS 1601), OEC data shows Germany as the largest single origin by value in 2024, accounting for 19.1% of import value (with other origins split across Poland, Belgium, Spain, Denmark and others).

It means German-style sausages remain commercially attractive because they are specification-led, easy to standardise, and operationally efficient—formats buyers can list and execute consistently even when the wider market is volatile.

A tight, high-performing core range typically includes: Bratwurst, Bacon Frankfurter, Chilli Beef Frankfurter, Cheese Frankfurter, Jumbo Pork Hotdog, and Munich Weisswurst—covering hero formats, premium cues, and a speciality SKU for occasions, without adding operational complexity.

Pigmeat is a high-volume, specification-led protein lane with direct links to processed formats like sausages. AHDB reports UK pigmeat imports at 789,300 tonnes in 2024, making it a major procurement category.

Because the UK remains structurally import-led in food and drink, and Germany is one of the UK’s most important source countries for food, feed and drink imports—so Germany is a meaningful supply lane, not a niche trend.

Conclusion

f you want a credible, buyer-relevant story for German food imports UK 2026, you do not need optimistic category-growth claims or speculative predictions. The strongest argument is structural and evidence-led: the UK remains a large food-import market, Germany is a top-tier source country within that system, and pigmeat is one of the clearest lanes where Germany matters because the UK’s import sourcing is overwhelmingly EU-based. In other words, the commercial relevance is not driven by a passing “trend” but by the underlying architecture of supply.

What to expect in 2026 is therefore less about hype and more about operational reality. Buyers will continue to prioritise stable SKUs, specification discipline, robust QA, and resilient contingency planning—especially in categories where biosecurity controls can create short-term volatility. The winners will be suppliers who reduce friction: clear documentation, predictable case formats, consistent weights, reliable availability, and products engineered for real throughput in retail and foodservice.

In that environment, German-style sausages remain a commercially meaningful lane because they sit directly inside the same procurement logic that makes Germany important to UK food supply in the first place: proven EU supply chains, widely understood product formats, and specification-led buying decisions. For retailers, that translates into clear merchandising, repeat purchase, and a premium-but-practical proposition. For foodservice, it translates into speed of execution, portion control, and menu builds that can be scaled without adding operational complexity.

The practical takeaway for 2026 is simple: treat “German-style” not as a niche seasonal theme but as a robust, repeatable range and menu lane. Build around a small number of hero SKUs, standardise preparation, and use variants (toppings, sauces, bun formats, seasonal specials) to drive margin without multiplying complexity. That approach aligns with how buyers actually purchase in 2026—protecting availability, protecting specification, and protecting the customer experience—even when the market throws short-term disruption into the system.

About The Sausage Haüs

The Sausage Haüs supplies authentic German sausages to UK retail and foodservice, designed for consistent quality, dependable handling, and strong customer appeal across real service conditions. Our range is built around proven German formats that are easy to merchandise and execute—whether you are running a chilled/frozen retail fixture, a pub menu, a food-to-go counter, events catering, or high-throughput street food.

We focus on specification discipline and operational reliability: consistent weights and case formats, predictable cooking performance, and a product build that delivers the hallmark “German” cues buyers and consumers expect—firm texture, clean seasoning, and the right balance of lean meat and fat for flavour and bite. That consistency makes it easier to standardise menus, control portions, and protect margin, while still offering a premium product story.

Our sausages are produced with heritage expertise in Germany, including our partner Remagen (founded in 1718), and supported by UK distribution through Baird Foods. This structure helps customers access authentic products with practical UK availability—reducing friction for procurement teams and supporting dependable replenishment. In short: The Sausage Haüs helps UK buyers bring credible German sausage formats to market with the consistency, documentation, and logistical dependability needed for modern retail and foodservice.